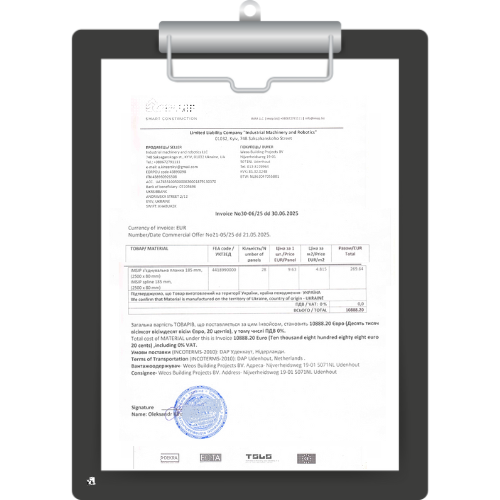

Commercial Invoice

The primary financial document in international sales—confirming price, terms, and title (ownership).

Who it’s for:

Exporters, importers, customs brokers, and banks handling documentary letters of credit (L/Cs).

Validity

One-off for the specific shipment; must be retained for at least 5 years for VAT and customs audits (Directive 2006/112/EC, Art. 244).

Regulatory Framework

Download the sample

What is a Commercial Invoice?

A commercial invoice is the bill of sale for an international transaction. It sets out the full details of the deal: seller and buyer, goods description, quantity, price, Incoterms, currency, and payment method. For customs, it serves as the primary document evidencing the transaction value.

Forms the basis for assessing customs duties and VAT (UCC Art. 70).

Required by banks for foreign-exchange control, letters of credit, and collection.

May be electronic under the eFTI Regulation (EU) 2020/1056 and must include a qualified digital signature or an EDI identifier.

Need help?

Alstera will prepare your invoice in line with EU CDM v6 (EU Customs Data Model), and verify HS codes, FX (foreign-exchange) control, and bank requirements.

Get a consultation

Frequently asked questions

Yes— a combined CI/PL is allowed, provided that both customs and your bank accept this format; make sure pricing information is clearly separated from the physical shipment details.

It’s recommended when payment is under an L/C—it speeds up the bank’s document examination and reconciliation.